does irs forgive tax debt

Stafford Disaster Relief and Emergency Assistance Act. If you accept part payment on the balance of the buyers installment debt to you and forgive the rest of the debt you treat the settlement as a disposition of the installment obligation.

Irs Courseware Link Learn Taxes

Other types of student loan forgiveness however are taxable.

. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. However there are a few things to consider. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

Also the Times website does not have rights to certain freelance articles book excerpts and opinion essays most of these published during the 1980s and 1990s. Before Marriage The IRS cannot come after you for your spouses taxes if they incurred their debt before you said I do Any tax debt your partner accumulated before marriage is their own responsibility which means your tax refund is protected. Special rules for tax-favored withdrawals and repayments from certain retirement plans.

Failure to Deposit applies when you dont pay employment taxes accurately or on time. A request for an offer in compromise on Form 656 is made to settle your tax debt for less than you are owed. Erroneous Claim for Refund or Credit Penalty applies when you submit a claim for refund or credit of income tax for an excessive amount and reasonable cause does not apply.

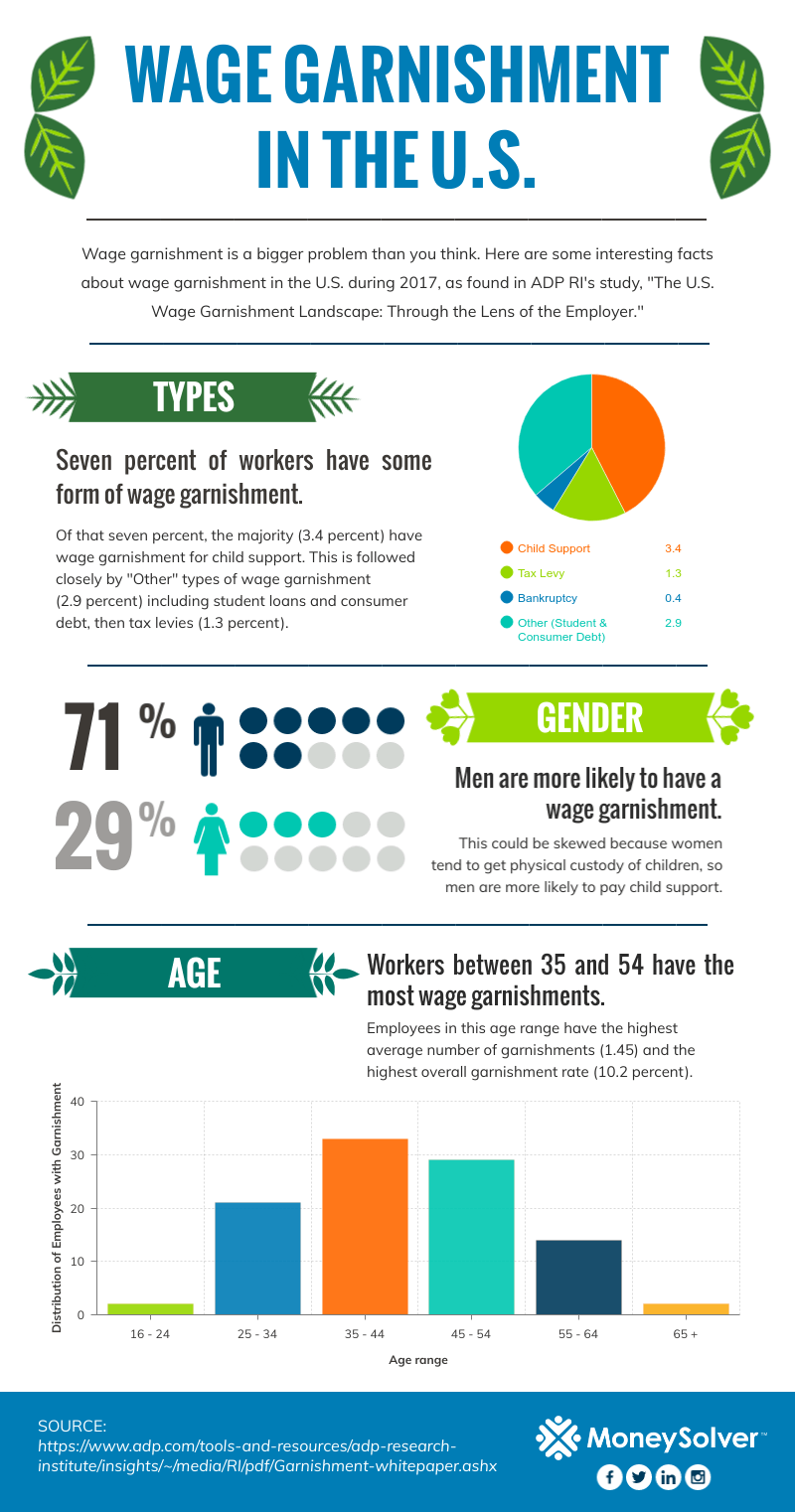

The IRS says forgiven debt is taxable for the year settled unless you are financially insolvent. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Seriously delinquent tax debt can cause your passport to be restricted.

The IRS seldom forgives tax obligations. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally resolved. In general you must report any taxable amount of a canceled debt as ordinary income from the cancellation of debt on Form 1040 US.

We consider your unique set of facts and circumstances. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. Read breaking headlines covering Congress Democrats Republicans election news and more.

Thats why its crucial to determine if you qualify as insolvent or if you need to budget for those taxes. Our experienced journalists want to glorify God in what we do. Time Limits on the IRS Collection Process.

Be informed and get ahead with. Find out if you could be impacted and learn how to fix the problem. If the IRS does select the estates return for examination and redetermines the tax shown on the return the trustee may contest the IRSs determination in bankruptcy court.

The IRS has 10 years to collect on a debt from the time it was assessed with some exceptions. Different IRS Tax Brackets 2023 The standard deduction - part of your earnings that the IRS simply ignores - has been raised by around 7pc depending on your income marking the largest adjustment. And taxpayers may also waive receiving the said notice if they are going to pay their tax debt via the Direct Debit Installment Agreement.

Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years.

Form 1040EZ is generally used by singlemarried taxpayers. However the IRS can forgive the tax debt of borrowers who are insolvent where total debt exceeds total assets 26 USC 108a1B and d. Nonresident Alien Income Tax Return as other income if the debt is a nonbusiness debt or on an applicable schedule.

On the federal level student debt relief is tax exempt until 2026 due to a provision in the American Rescue Plan Act. This non-impact trait applies to both federal and state tax liens. 5 - February 28 2018 at participating offices to qualify.

So does the IRS forgive tax debt after 10 years. Again it bears repeating that tax liens no longer impact the credit score of a delinquent taxpayer. Audio versions of top stories are available via smart speaker or as a podcast.

Does not have the statutory authority to cancel compromise discharge or forgive on a blanket or mass basis principal. Individual Income Tax Return Form 1040-SR US. First reduce the loss for the tax year of the debt cancellation and then any loss carryovers to that year in the order of the tax years from which the carryovers arose.

This means the IRS should forgive tax debt after 10 years. Tax Preparer Penalties apply to tax return preparers who engage in misconduct. If you fail to file your tax return or make any payments on your obligation your tax debt will quickly rise.

Tax Return for Seniors or Form 1040-NR US. For example the forgiveness of the remaining debt after 20 or 25 years in an Income-Driven Repayment IDR plan is taxable under current law. Your gain or loss is the difference between your basis in the obligation and the amount you realize on.

NW IR-6526 Washington DC 20224. IRS Announces New Tax Brackets And Standard Deduction For 2023. But in Mississippi where the state tax code differs from the federal governments the Department of Revenue plans to tax student loan forgiveness the way it does any form of debt cancellation as income.

Comments and suggestions. New rules provide for certain tax-favored withdrawals and repayments from certain retirement plans for taxpayers who suffered economic losses as a result of disasters declared by the President under section 401 of the Robert T. However sometimes the IRS may intercept your refund and put it toward your spouses back taxes.

Be honest with yourself about your position. Type of federal return filed is based on your personal tax situation and IRS rules. We welcome your comments about this publication and suggestions for future editions.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. If youre a married couple and your creditors forgive 10000 of debt your tax would range from 1000 to 3700. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

It may be a legitimate option if you cant pay your full tax liability or doing so creates a financial hardship.

What Is The Irs Debt Forgiveness Program Tax Defense Network

Irs Audit Letter Cp518 Sample 1

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Can I Qualify For Irs Debt Forgiveness In Bankruptcy Oaktree Law

Five Signs That You Need Back Taxes Help Now Tax Defense Network

Amazon Com Owe 10k More Or Less To The Irs In Taxes Owe 10k Or More To Irs How To Permanently Solve Your Irs Stop Collection Activity The Taxman Irs Off Your Back

How To Get Tax Amnesty A Guide To The Forgiveness Of Irs Debt Including Penalties Interest Daniel J Pilla Paul Engstrom 9780961712495 Amazon Com Books

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Irs Payment Plan Pros And Cons Of Irs Payment Plans Tax Debt Relief Services

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

When Can The Irs Come After A Business Personally

How To Get Tax Amnesty A Guide To The Forgiveness Of Irs Debt Daniel J Pilla Ebay

Owe Taxes To The Irs What To Do When You Can T Pay

Tax Debt Relief 20 20 Tax Resolution The Tax Experts

Could You Qualify For Irs Tax Debt Forgiveness Five Stone Tax Advisers

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com