surrender green card exit tax

As a Green Card GC holder you have the same tax filing requirements as US citizens. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

Make Sure You Ve Got These Tax Bases Covered Before Moving To The Us The Economic Times

An individual who is a long-term resident of the US.

. At that point file Form I-407 nuke. Lets talk about the exit tax implications of the treaty election by this green card holder to be treated as a nonresident of the United States for income tax purposes. This can mean that green card holders who have not formerly surrendered the green card are stuck.

What is the US. A longterm resident is defined as any individual. If you choose to give up on the American dream and surrender your Green Card.

Surrendering a Green Card US Tax Rules for LTRs. Citizens who have renounced their. Citizenship or decide to give up your Green Card you need to tie up loose ends with the IRS by ensuring youre all paid up on your.

You can surrender a Green Card without triggers any exit or departure tax. LPRs who have held the card for a significant time are called long term residents LTR for US tax purposes. May be required to pay an exit tax on surrender of his or her green card.

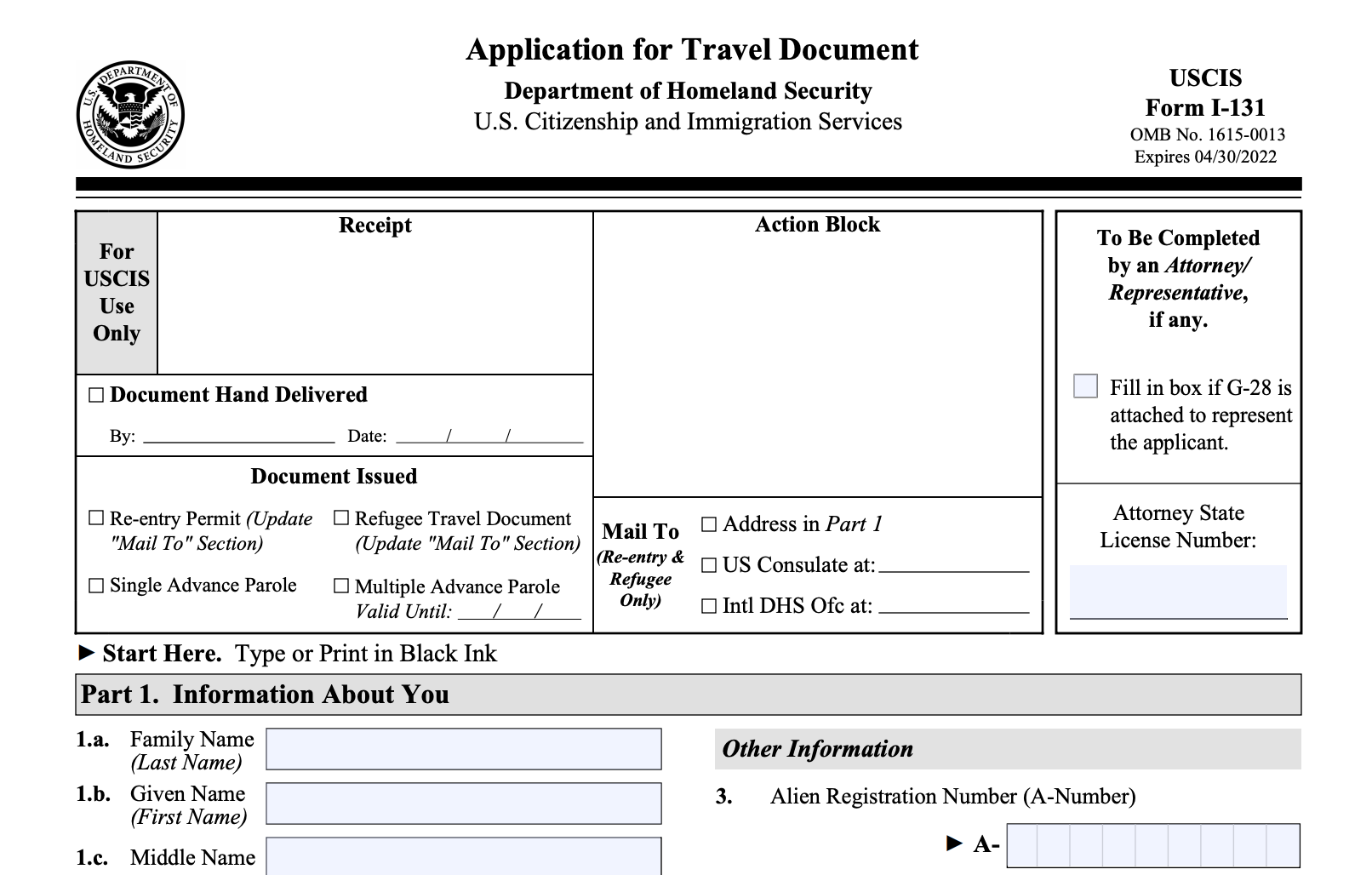

Ensure you complete a Form I-407 as the termination of your green card. The surrender of US. The expatriation tax provisions apply to US.

This can mean that green card holders who. Todays blog post examines the US tax issues that surround relinquishing the green card especially at the point of entry when circumstances are not ideal for tax planning. Surrender of Green Card WARNING for LTRs.

Your income tax filing requirement and possible obligation to pay US. It will be as. Green card holders are required to adhere to US tax laws.

When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and. When you renounce your US. This might be a way for a wealthy green card holder to move abroad and stay abroad and wait out the application of the exit tax rules.

Generally an LTR is. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. If however you have had permanent residence for more than 8 of the last 15 years and your assets exceed 2.

Surrender Green Card after 8 Years When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed distribution. Citizens who have relinquished their citizenship and to long-term permanent residents green card holders who have ended their US. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

In some cases you can be taxed up to 30 of your total net worth. Currently net capital gains can be taxed as high as. Citizenship must be recognized by the proper immigration and tax authorities.

Your tax responsibilities as a green card holder do not change if you are absent from the US. If you are covered then you will trigger the green card exit tax when you renounce your status. For any period of time.

Re Entry Permits For Green Card Holders Explained

Renounce U S Here S How Irs Computes Exit Tax

Abandoning Your Green Card The Implications Effisca

Giving Up Your Green Card Conductlaw

Make Sure You Ve Got These Tax Bases Covered Before Moving To The Us The Economic Times

Strength Weaknesses Of Giving Up Us Citizenship

Exit Tax In The Us Everything You Need To Know If You Re Moving

Will You Pay A Us Exit Tax Because Of Your Green Card

How To Renounce Us Citizenship Americans Overseas

Giving Up Your Us Green Card Americans Overseas

Failure To File Irs Form 8854 After Surrendering A Green Card Or After Expatriation Htj Tax

Do Green Card Holders Living In The Uk Have To File Us Taxes

Failure To File Irs Form 8854 After Surrendering A Green Card Or After Expatriation Htj Tax

Overview Of U S Expatriation Cardinal Point Wealth Management

Pre Immigration Tax Planning Attorneys Castro Co

What To Consider When Deciding To Renounce U S Citizenship For Tax Purposes The Globe And Mail

U S Tax Court Rules On Consequences Of Surrendering A Green Card Wealth Management